Tiger Global Management, the prominent investment firm founded by Chase Coleman, has gained attention for its aggressive venture capital investing in recent years. The firm has backed numerous high-growth technology companies, including 44 Prime Unicorn Index components, across sectors like software, consumer, healthcare, and more. In this post, we’ll highlight some of Tiger Global’s investments that are components of the prestigious Prime Unicorn Index.

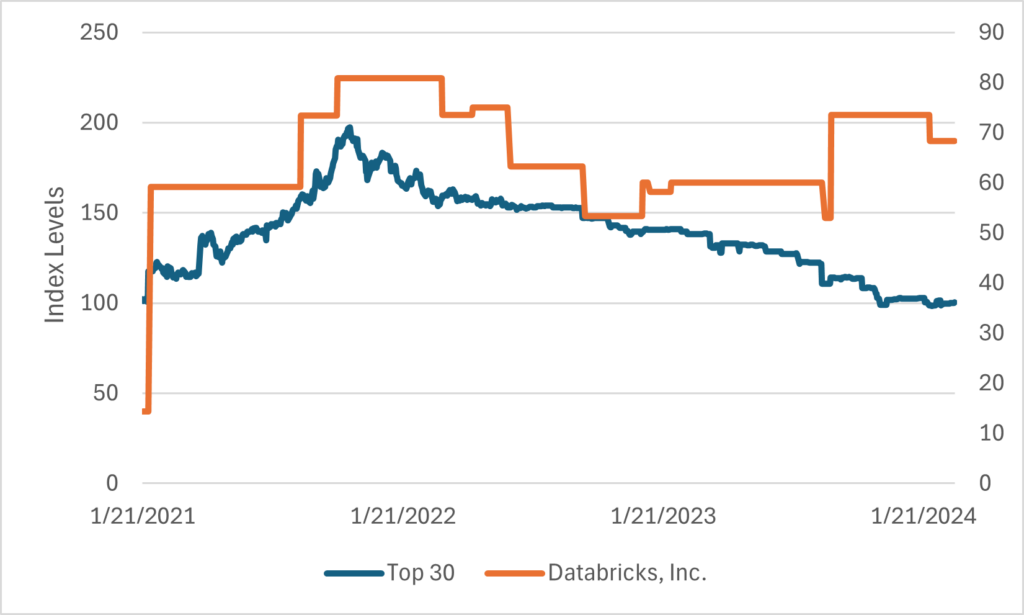

Databricks, Inc.

Based in San Francisco, Databricks provides a unified data analytics platform for data engineering, machine learning, and analytics use cases. The company has raised over $4 billion in funding from investors like Andreessen Horowitz, New Enterprise Associates, and Tiger Global. In its most recent Series I round in September 2023, Databricks raised nearly $685 million at a staggering $35 billion valuation.

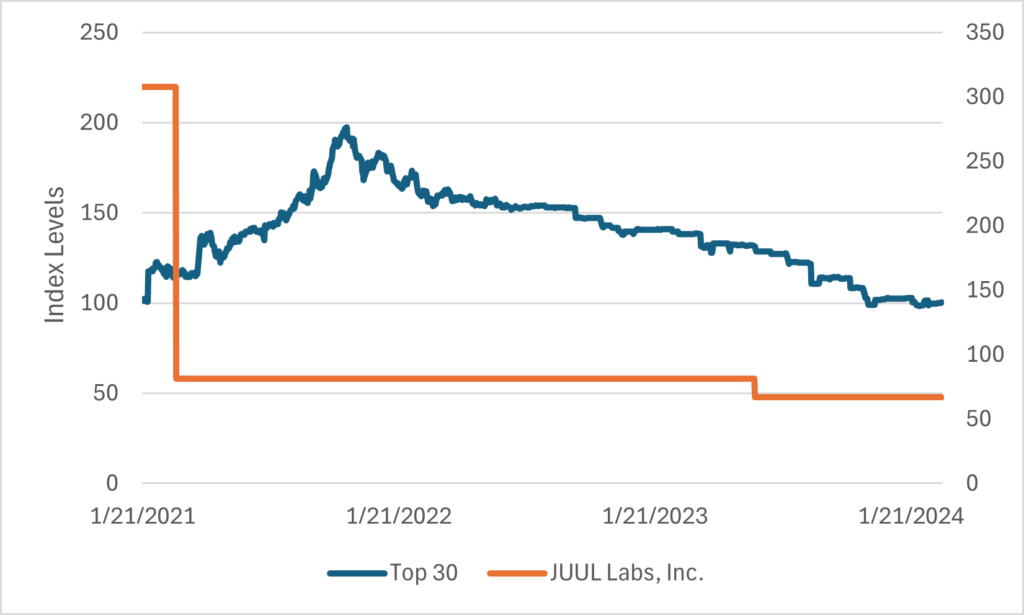

JUUL Labs, Inc.

The controversial vaping company JUUL has faced increasing regulatory scrutiny in recent years. However, its $8.8 billion valuation, adjusted for markdowns in its internal valuation, still makes it one of the largest companies in the Prime Unicorn Index. JUUL has raised $16.3 billion from investors, including Tiger Global.

Relativity Space, Inc.

Relativity Space is a trailblazing aerospace company pioneering the use of 3D printing and robotics to produce rockets and other components. Based in Long Beach, California, it achieved unicorn status after raising over $1.3 billion from investors such as Tiger Global, Blue Origin, and others. In its Series E round in November 2022, the company raised $650 million at a $4.3 billion valuation, with Tiger participating.

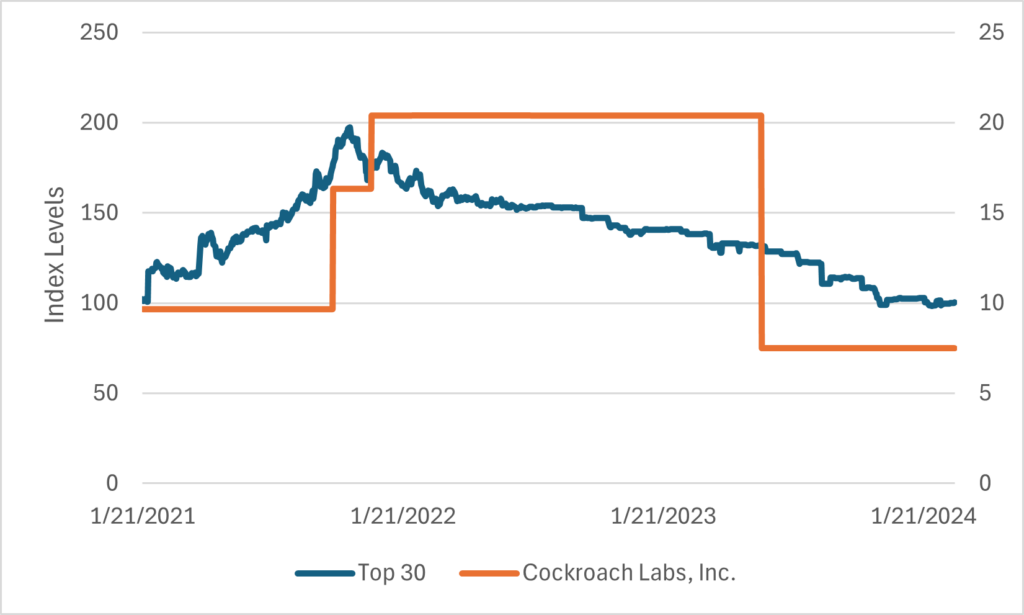

Cockroach Labs, Inc.

This cloud-native SQL database company is taking on incumbents like Oracle with its distributed, geo-partitioned database built for modern cloud applications. After raising capital from investors like GV, Altimeter Capital, and BOND, Cockroach Labs joined the Prime Unicorn Index when Tiger Global led its $278 million Series F financing round at a $4.9 billion valuation in December 2021.

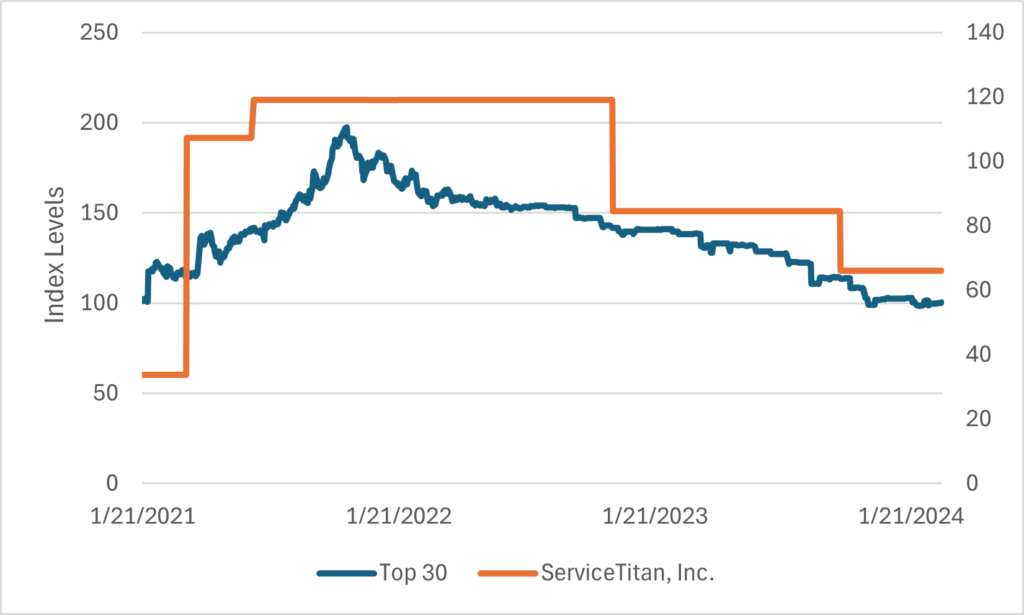

ServiceTitan, Inc.

ServiceTitan offers cloud-based software to help residential home service companies streamline operations and grow their businesses. The company’s vertical SaaS platform serves industries like plumbing, HVAC, electrical and more. In 2021, ServiceTitan achieved a $8.1 billion valuation after raising $200 million in a Series G round led by Tiger Global and Thoma Bravo. It has since been marked down to a $5.8 billion valuation in the Prime Unicorn Index.

Through these investments spanning diverse sectors, Tiger Global has gained significant exposure to some of the most highly-valued private technology companies tracked by the Prime Unicorn Index. The firm’s prolific venture capital strategy positions it to capture upside from potential landmark exits like public offerings or acquisitions in the years ahead.

However, Tiger Global has faced significant markdowns and writedowns on its private portfolio amid the broader tech valuation reset of the past year. The firm marked down the valuations of several holdings, including Instacart, Databricks, and Klarna, by billions of dollars in 2022. Tiger was also a major investor in several companies that saw their valuations plummet after going public, such as Robinhood, Coinbase, and Revolut.

To manage its exposure, Tiger has reportedly explored opportunities to trim its stakes in some underperforming late-stage companies through secondary share sales to other investors. While the Prime Unicorn Index still houses many of Tiger’s most valuable bets, the firm’s recent challenges underscore the rising risks facing major venture capitalists after a decade of booming startup valuations.