In today’s dynamic private market landscape, accurate and transparent valuation metrics have never been more crucial. The Prime Unicorn 30 Index stands as a cornerstone for measuring the performance of the leading private companies, built on principles of verifiability, transparency, and deep market expertise.

A Foundation of Accuracy

The Prime Unicorn 30 Index is a modified market cap price return index tracking U.S. private venture-backed companies valued at $1 billion or more. What sets this index apart is its unwavering commitment to data integrity. Every price change for a component derives exclusively from verifiable, publicly available sources, including state and federal filings and documented transactions.

Stanford Graduate School of Business Professor Ilya Strebulaev, an advisor to the Prime Unicorn Index says, “The expertise of the Prime Unicorn Index team, methodology, and their conviction to providing transparency to participants in today’s private capital markets are important qualities for the ecosystem.”

This commitment to transparency extends to our treatment of secondary market data captured through Caplight. While secondary transactions can provide valuable insights, we include only closed transactions above established thresholds. This methodical approach stands in contrast to relying on mere indications of interest or opaque pricing mechanisms that may not accurately reflect true market values.

Rigorous Component Selection

Our market cap-weighted methodology ensures that the index accurately represents the economic significance of each component. The Prime Unicorn 30 Index components are selected from the broader Prime Unicorn Composite Index. The quarterly reconstitution process maintains dynamism while preventing excessive turnover: companies breaking into the top 15 by market cap immediately enter the index, replacing the lowest-ranking component. Conversely, companies falling below rank 50 or completing their public market lockup period exit the index, maintaining its focus on the private market’s leading players.

Pioneering Expertise

The Prime Unicorn 30 Index builds on over a decade of specialized private market knowledge. Through VC Experts’ comprehensive database of over 37,000 Certificates of Incorporation and 20,000+ sets of accompanying deal terms, we bring unparalleled depth of understanding to private market dynamics. This expertise informed the launch of the original Prime Unicorn Index in August 2017 – the market’s first private company index – and continues with our enhanced indices incorporating secondary pricing, launched in January 2024.

Performance and Market Perspective

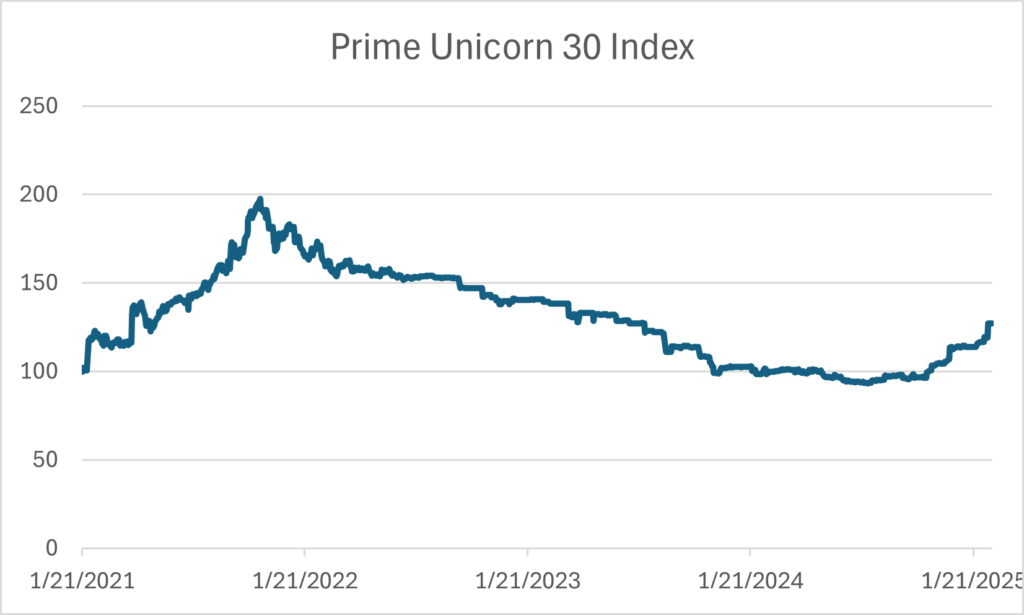

The index’s journey reflects the evolving private market landscape. From its base level of 100 in January 2021, the Prime Unicorn 30 Index reached an all-time high of 197.5 during the late 2021 market surge. After falling to levels as low as 93.4 in 2023, the index saw a 10.9% gain in 2024. As of February 18, 2025, the index stands at 127.07, reflecting both the market’s maturation and its continued growth potential.

Looking Forward

As private markets continue to evolve, the need for reliable, transparent valuation metrics becomes increasingly critical. The Prime Unicorn 30 Index’s combination of rigorous methodology, verifiable data sources, and deep market expertise provides investors and market participants with a trustworthy benchmark for understanding private market dynamics and lays the groundwork for sound financial products.

The Prime Unicorn Index was designed and developed by Lagniappe Labs and Level ETF Ventures’ Prime Indexes group. For more information, please visit www.primeunicornindex.com or call (646) 290-9254.