Databricks is the developer of an integrated analytics platform aimed at simplifying complex data analysis. The platform streamlines data amalgamation, enables real-time data investigation, offers interactive digital notebooks, and incorporates seamless workflows while ensuring enterprise-level security. By bringing together data science, engineering, and business operations, the platform enhances the efficiency, performance, and security for data science teams in a fine-tuned runtime environment. It is also a component of the Prime Unicorn Index, the standard bearer for private markets benchmarking. Reflecting the broader private market, the Index is down 7.01% year-to-date.

Last week, we covered Databricks and the recent news surrounding the company, including an upcoming raise. This raise was announced as a $500 million Series I round on Thursday, August 14, which values the company at $35 billion on a post-money valuation basis. The round was priced at $73.50, slightly higher than its previous PPPS of $73.48. The round was led by T. Rowe Price, with participation from Andreessen Horowitz, Fidelity, Tiger Global, Counterpoint Global, Capital One Ventures, and NVIDIA, among others.

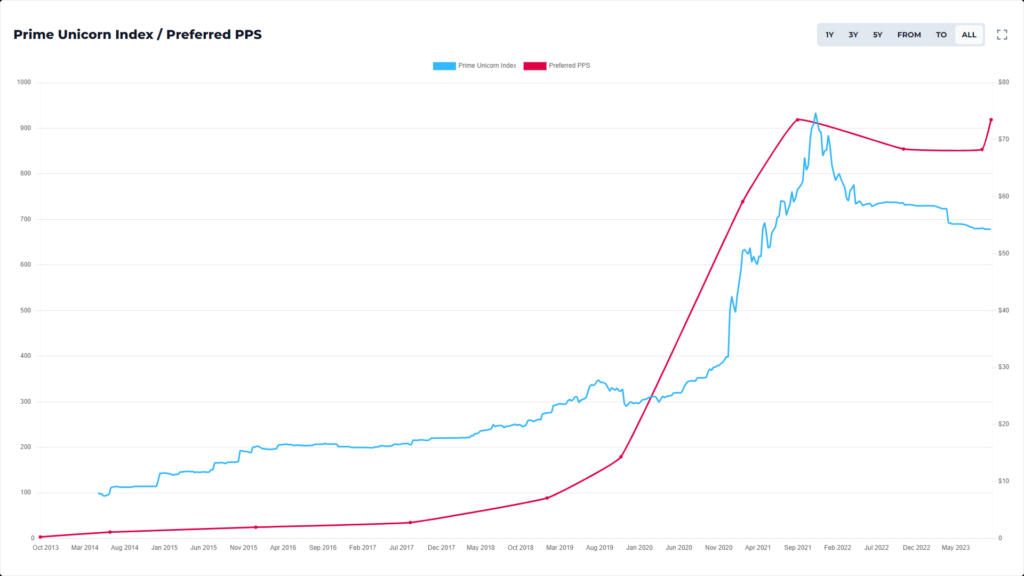

Prior to this round, Databricks raised a $1.6 billion Series H round at a PPPS of $73.48 in August 2021. Since then, the company has been marked down twice in the Prime Unicorn Index due to EPEN filings, which reflect a decrease in the value of the common shares offered to company executives. Its last PPPS in the Index was $68.27 following an EPEN filing on August 10, 2023.

See how Databricks has performed against the Prime Unicorn Index below.