Anthropic, one of OpenAI’s biggest competitors, is making waves again with its latest funding round. According to recent reports, the AI startup is in talks to raise $2 billion at a $60 billion valuation, with Lightspeed Venture Partners leading the round. This would cement Anthropic as the fifth most valuable U.S. startup, trailing only SpaceX, OpenAI, Stripe, and Databricks.

Series E Price Jump and Secondary Market Activity

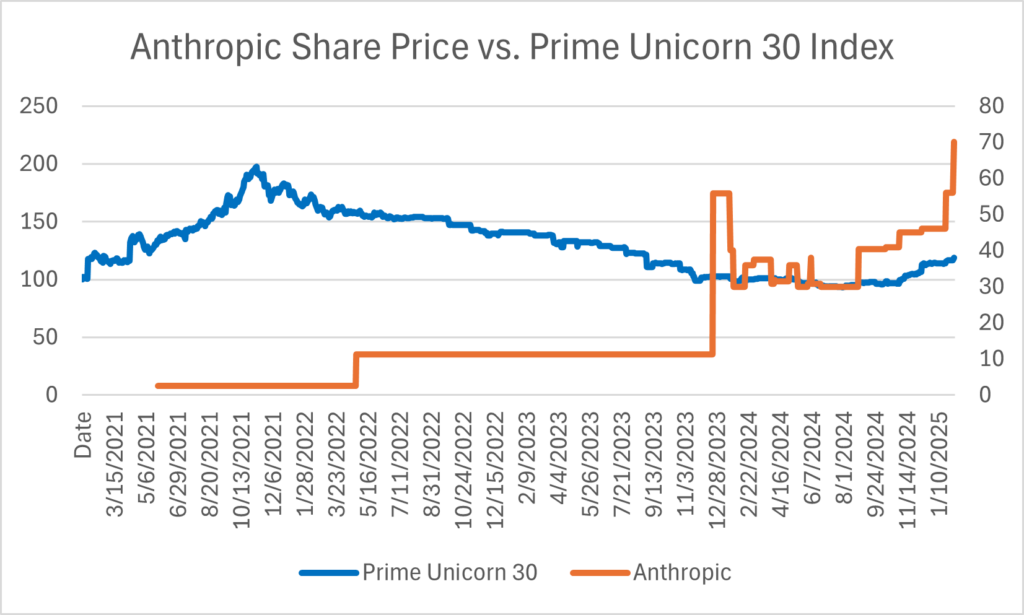

A January 27, 2025, filing with the state of Delaware revealed that Anthropic priced its Series E shares at $56.09, a notable increase from the $30 Series D price. But perhaps even more telling is the secondary market reaction—Anthropic’s shares are already trading at $70, according to Caplight, signaling strong investor confidence and anticipation of further upside.

The Capital Arms Race in AI

Anthropic’s raise follows its $4 billion deal with Amazon in late 2024, securing AWS as its primary AI cloud partner. The AI sector continues to demand massive capital injections—OpenAI raised $6.6 billion in October 2024, and Elon Musk’s xAI secured $6 billion in November 2024. These investments reflect the compute-intensive nature of AI development, where deep-pocketed investors are crucial to scaling foundational models.

Market Shakeups: Anthropic Amid the DeepSeek Fallout

Anthropic’s raise comes at a time when U.S. AI firms are on edge following the rise of DeepSeek, the Chinese-backed AI company that rattled regulators and investors alike. While DeepSeek’s tech ambitions faced hurdles—including reports that Apple rejected its model for use in China—its emergence has intensified geopolitical concerns around AI dominance. This backdrop makes Anthropic’s ability to secure major funding from U.S. investors even more significant as firms position themselves for the next phase of AI competition.