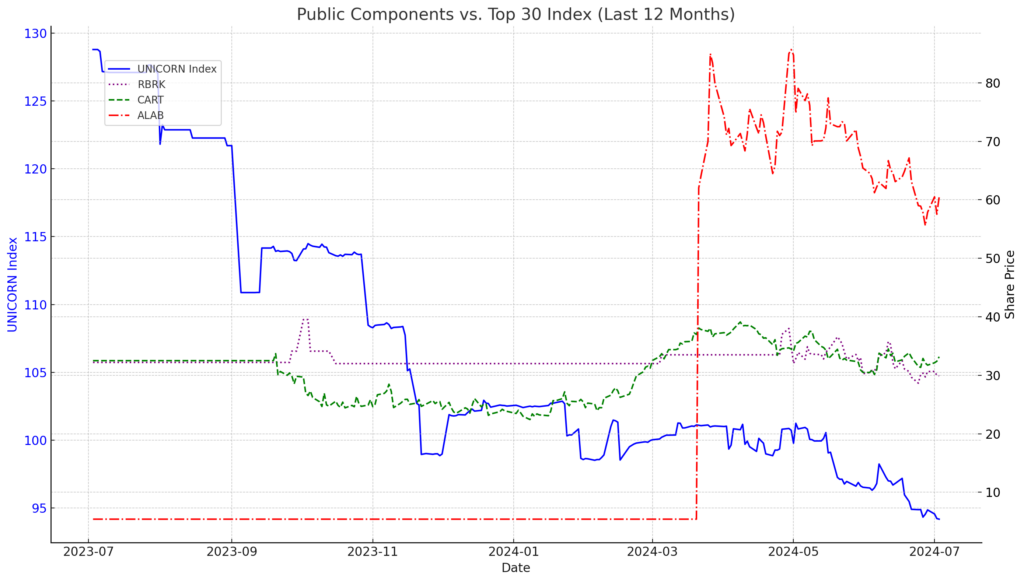

Last week, we covered a handful of components that appear to be eyeing an IPO in the near future. However, much of this depends on the current performance of the public markets and, more specifically, other recent IPOs. The Prime Unicorn Index retains companies for a period after its IPO to mirror a traditional lockup period and capture some of the initial price discovery. Let’s take a look at how the current public components are performing.

The Index currently contains three public companies: Maplebear (CART), Astera Labs (ALAB), and Rubrik (RBRK). All three companies are trading near or above their respective IPO prices:

Maplebear, currently trading at $34 per share, went public in September 2023 at $30 per share. Although the company is trading above its initial offering, this price is significantly below its last private round preferred price per share of $125 and its ATH of $42.95.

Astera Labs, currently trading at $56.97, has seen a huge gain since going public at $36 per share earlier this year. This is a massive increase from its Series D price of $10.17, but still down from recent highs of $95.91.

Rubrik, which went public at $32 per share this year, is trading relatively flat at $32.62. However, this shows a 38.5% gain from its last round price of $23.55. It is down from a high of $40.

Overall, the public markets are sending mixed signals. While companies like Astera Labs have made tremendous gains while riding the AI wave, other recent IPOs such as Maplebear and Rubrik have remained flat in the public markets.

While the S&P 500 and Nasdaq Composite are hitting record highs, this is being driven by a handful of companies, such as Nvidia and Microsoft, and is not reflected across the market as a whole. The Prime Unicorn 30 Index shows that when including secondary marks, the private markets are down 8.1% YTD.

See how the Top 30 Index is performing against public components below.