Travel software company Navan (FKA: Tripactions) has recently announced a reduction of its global workforce by 5%, impacting around 145 employees, as reported last week by The Information. This move comes at a pivotal time as Navan is gearing up for a public offering. Earlier in the year, the company collaborated with Goldman Sachs for IPO preparations and informed its employees of a potential public launch as early as July. However, a shift in executive roles, particularly the replacement of CFO Thomas Tuchscherer with Ram Bartov, suggests a possible delay in these plans, especially in a market where tech IPOs are scarce.

Navan aims to accelerate its path to profitability, leading to the decision to streamline its workforce. This strategy is part of a broader plan to enhance operational efficiency. The company’s financial trajectory has seen significant fluctuations; after experiencing a revenue drop from $49 million in 2020 to $17 million in 2021, Navan saw revenue surge to $300 million last year, bolstered by the resurgence in business travel.

This isn’t the first time Navan has had to make tough decisions regarding its staff. The company previously conducted layoffs at the onset of the pandemic in 2020.

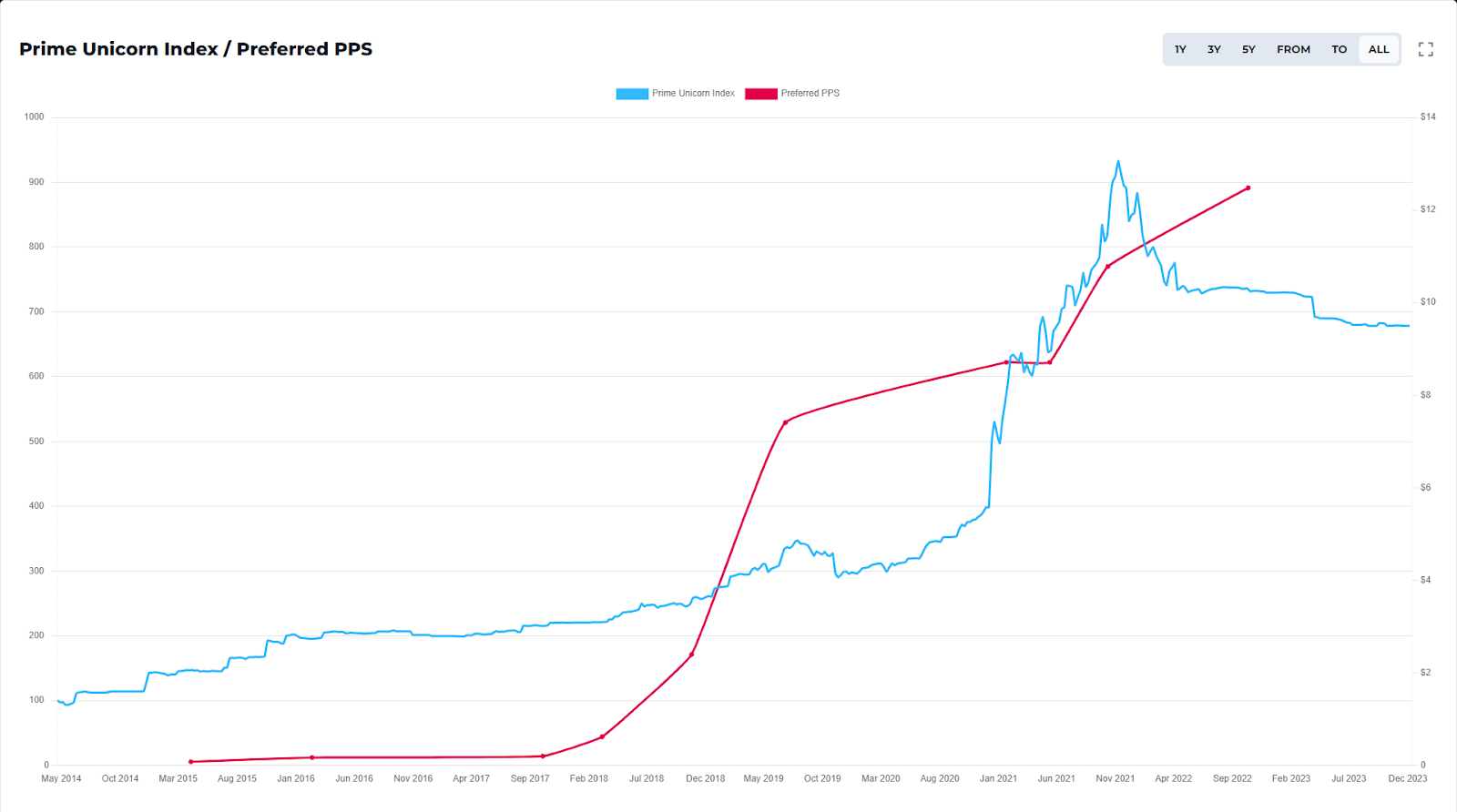

Navan has raised a total of $1.47 billion over nine rounds. Its most recent round was a $354 million Series G in October 2022 that valued the company at nearly $9 billion at a preferred share price of $12.48. Investors include Coatue, Greenoaks, Base Partners, Andreessen Horowitz, Lightspeed, Zeev Ventures, and others.

See how Navan has performed against the Prime Unicorn Index below.