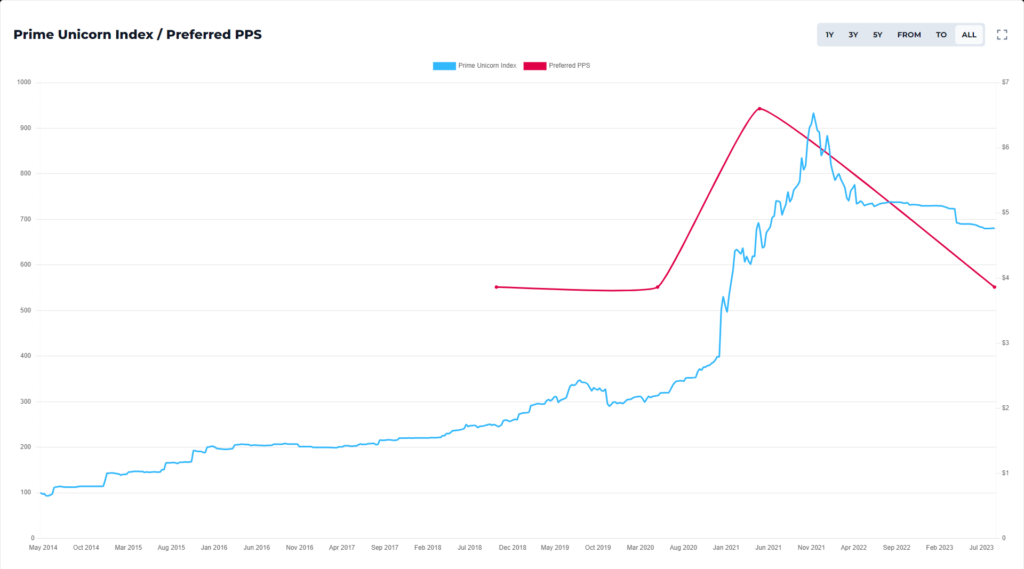

The Prime Unicorn Index benchmark, the standard bearer for private markets benchmarking, tracks post-money valuations for U.S-based, VC-backed private companies. Reflecting the broader private market, the Index is down 6.92% year to date.

ASAPP, Inc. builds AI-Native® products to solve large, complex, data-rich problems by automating and augmenting human workflows, radically improving efficiency and effectiveness to empower people to be their best. It is also a component of the Prime Unicorn Index.

ASAPP has raised four times, most recently a $117.77 million Series C round in April 2021 at a preferred price per share of $6.60. This valued the company at roughly $1.5 billion and included participation from Fidelity, Emergence Capital, March Capital, Telstra Ventures, and others. Prior to its Series C, ASAPP raised a $185 million Series B round in October 2018 and May 2020 at $3.86 a share, a $41 million Series A round in April 2017 at $1.41 a share, and a $7.57 million Seed round in December 2015 at $0.31 a share.

On August 16, 2023, ASAPP authorized a Series D round at a preferred price per share of $3.86, the same price as its Series B round. This would be a 41.5% decrease in share price and puts ASAPP in jeopardy of losing its unicorn status and inclusion in the Prime Unicorn Index. It is worth noting that no information regarding the Series D round has been released, making Prime Unicorn Index subscribers the first to know.

See how ASAPP has performed against the Prime Unicorn Index below.

Interested in learning more? Sign up for our benchmark tool here!